Understanding Rounding Bottom and Top Chart Patterns in Stock Market Analysis

The "Rounded Top" and "Rounded Bottom" chart patterns, commonly referred to as "rounding tops" and "rounding bottoms," are important formations in technical analysis, used to predict reversals in market trends. Here's a detailed look at these patterns using information from Thomas N. Bulkowski's "Encyclopedia of Chart Patterns, 2nd Edition."

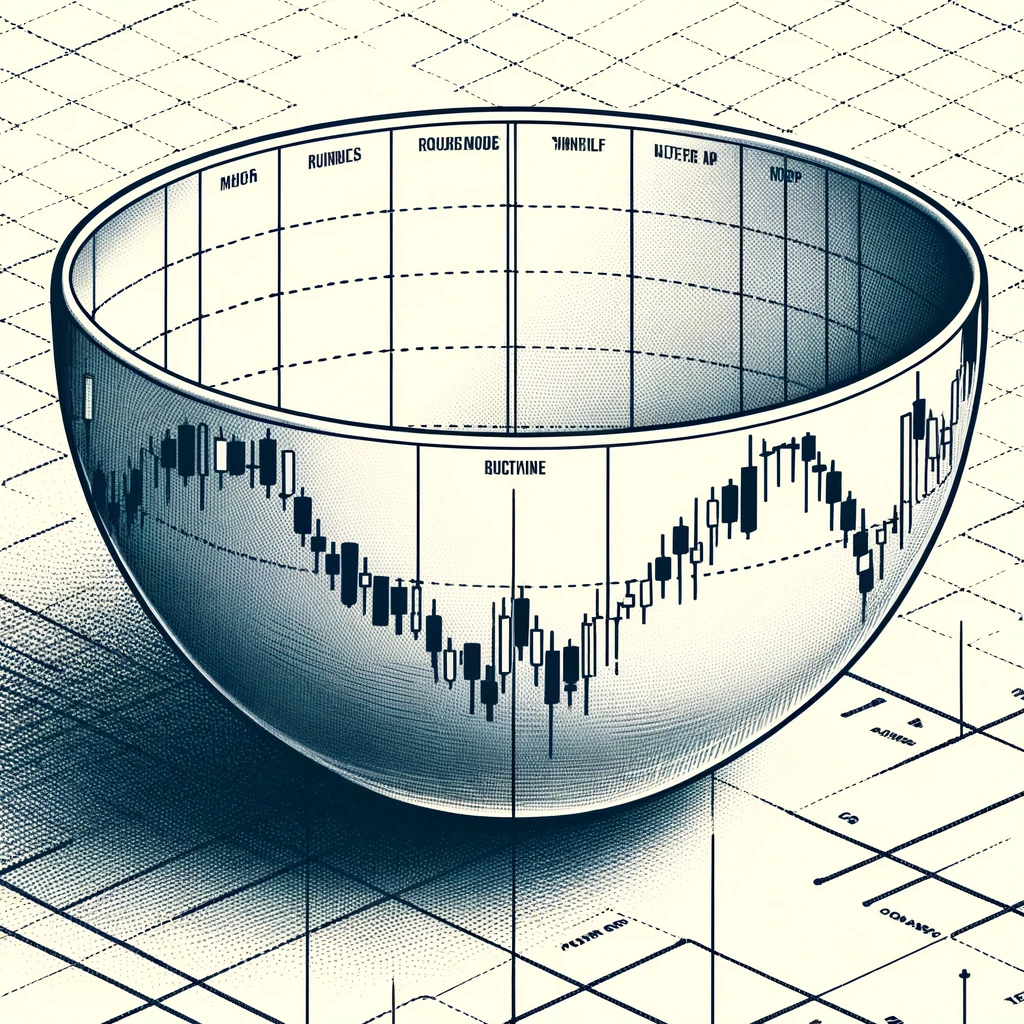

Rounding Bottoms (or Saucers)

Rounding bottoms, also known as saucers, are patterns that indicate a reversal from a bearish to a bullish market. They are long-term patterns that can last from several weeks to several months. The pattern resembles a bowl or a saucer, hence its name.

Identification Guidelines:

- Appearance: The pattern appears as a gradual and rounded turn in price action which resembles the shape of a bowl or a saucer.

- Volume: It typically shows a decrease in volume as the pattern forms, followed by an increase as the price starts to rise again.

- Price Trend: It begins during a downtrend, gradually bottoms out, and reverses to an uptrend.

Trading Considerations:

- Entry Point: Traders might consider entering a long position as the price breaks above the resistance level, which is often defined by a prior high or the upper boundary of the rounding formation.

- Stop-Loss: A stop-loss can be placed below the lowest point of the rounding bottom to limit potential losses.

- Price Target: The target can often be estimated by measuring the depth of the saucer and extending that distance upward from the breakout point.

Rounding Tops

Rounding tops are the inverse of rounding bottoms and signal a change from a bullish to a bearish market trend. This pattern is also known as an "inverse saucer."

Identification Guidelines:

- Appearance: This pattern features a gradual, rounded change in the price at the top of an uptrend, mirroring the shape of an upside-down bowl.

- Volume: Like rounding bottoms, volume tends to diminish as the pattern develops and increases as the price begins to decline.

- Price Trend: It starts during an uptrend, peaks out in a rounded fashion, and transitions to a downtrend.

Trading Considerations:

- Entry Point: Traders might consider taking a short position as the price breaks below the support level, which is typically the lower boundary of the rounding top.

- Stop-Loss: A stop-loss can be positioned above the highest point of the pattern to limit potential losses.

- Price Target: Similar to rounding bottoms, the price target for a rounding top can be projected by measuring the depth of the pattern and extending it downward from the breakout point.

Importance in Market Analysis

Both rounding tops and bottoms are crucial for market analysis because they help traders and analysts predict significant shifts in market sentiment and momentum, allowing for strategic entry and exit points in trades. These patterns are favored for their reliability and the clear trading signals they offer once confirmed.